This has been a crazy week in the stock market (and in news in general), so I wanted to check in with you and see how you are doing.

The news has been dominated by the outbreak of the Coronavirus the last few weeks. At first, the stock market brushed off the news, but this week has been tough in the markets as the virus continues to spread and investors worry about how it will impact the economy. Seeing the drop in the stock market the last few days, you may be tempted to sell. However, that may not be in your best interest. Please read this before taking any action.

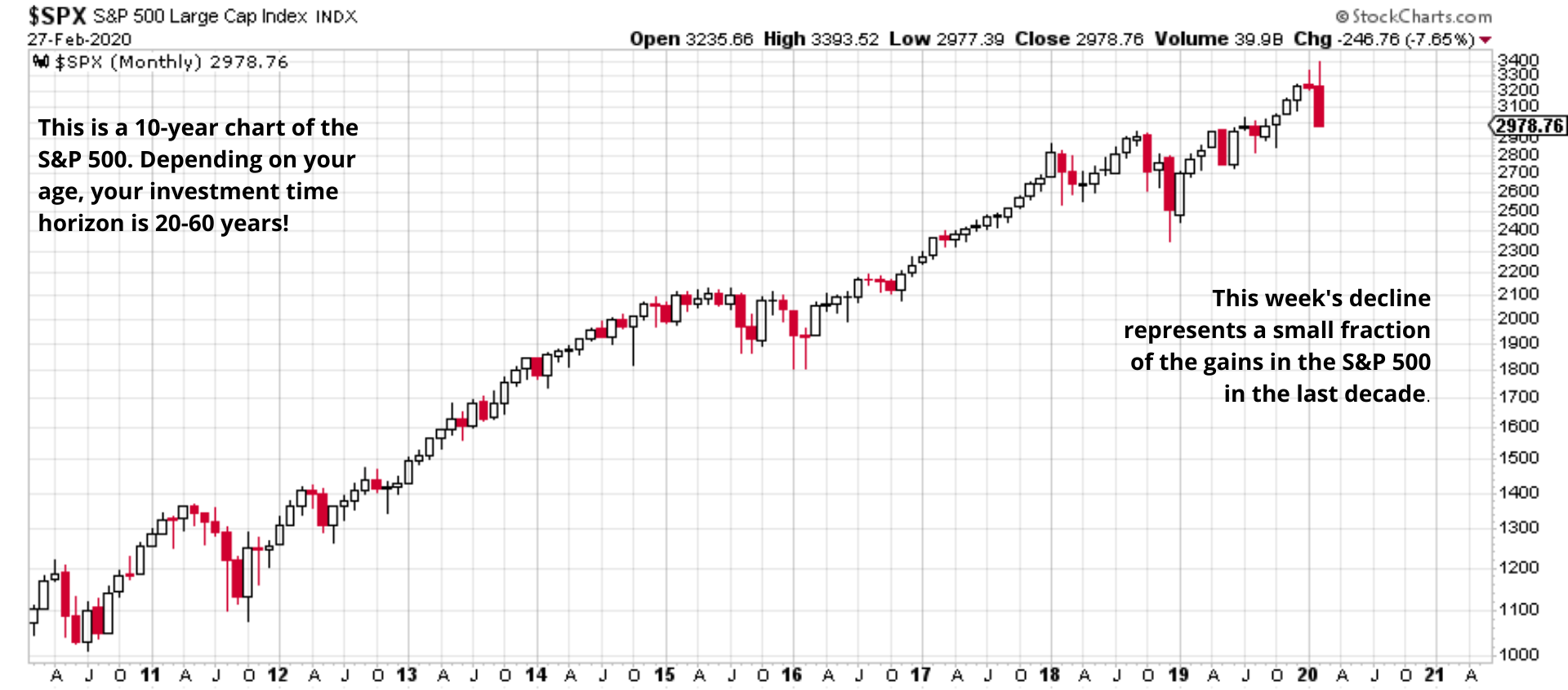

First, just to put the recent decline in perspective, here’s a monthly chart of the S&P 500 over the last 10 years:

Not to understate the drop in the market this week, but looking at the big picture, this week’s decline was a small percentage of the 100+ percent gains the stock market has enjoyed over the last decade. Even though short-term market corrections can feel painful at the time, when you have a 20, 30 or even 50-year time horizon, short term corrections aren’t as important as the long-term performance of your portfolio.

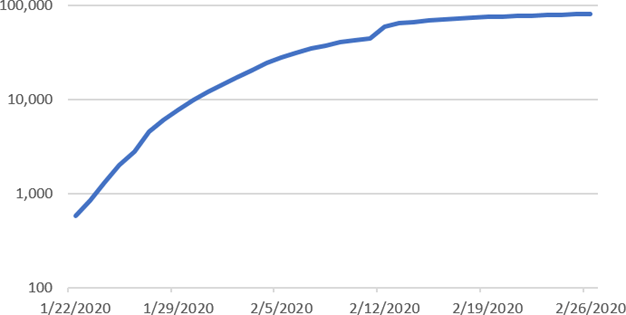

Second, what’s going on with the coronavirus? Despite the increased news this week, Worldometer shows that the number of total cases has actually leveled off.

Total Cases as of 2/26/2020

Source: Worldometer (combines stats from global health organizations)

Even though total cases have leveled off, the fear has increased as the virus is no longer contained to China. As the virus spreads through Europe and to the U.S., this could disrupt daily routines and economic activity. Adding to the fear are recent comments from the CDC that we could see a pandemic in the U.S. and that Americans should prepare for school and business closures.

No one knows what is going to happen with the coronavirus or how long it will take to contain it. On the financial side, the impact to the economy probably won’t be known until next quarter, at least. However, catalysts that move the stock market rarely have more than a temporary impact, and many times the recovery following the catalyst is strong. Note: The Federal Reserve isn’t ready to make changes yet, but if necessary, they can help support the economy with a rate cut. Currently, there is a 33% chance of a rate cut in March and a 68% chance the Fed will cut rates in the April meeting.

So, what should you be doing? Most likely, nothing. Market volatility is inevitable and you shouldn’t make changes to your portfolio every time the stock market goes down. Investors with well-diversified portfolios that match their risk tolerance and time horizon shouldn’t be concerned about short-term fluctuations. Even so, market corrections can be unnerving, so please reach out to me if you feel the need to rebalance your portfolio, especially if you believe your investments don’t match your risk tolerance.

Related Articles:

https://www.beacon-advisor.com/2015/08/stock-market-update-dont-panic/

https://www.beacon-advisor.com/2018/02/the-return-to-market-volatility/