by Kristine McKinley | Mar 20, 2020 | Uncategorized

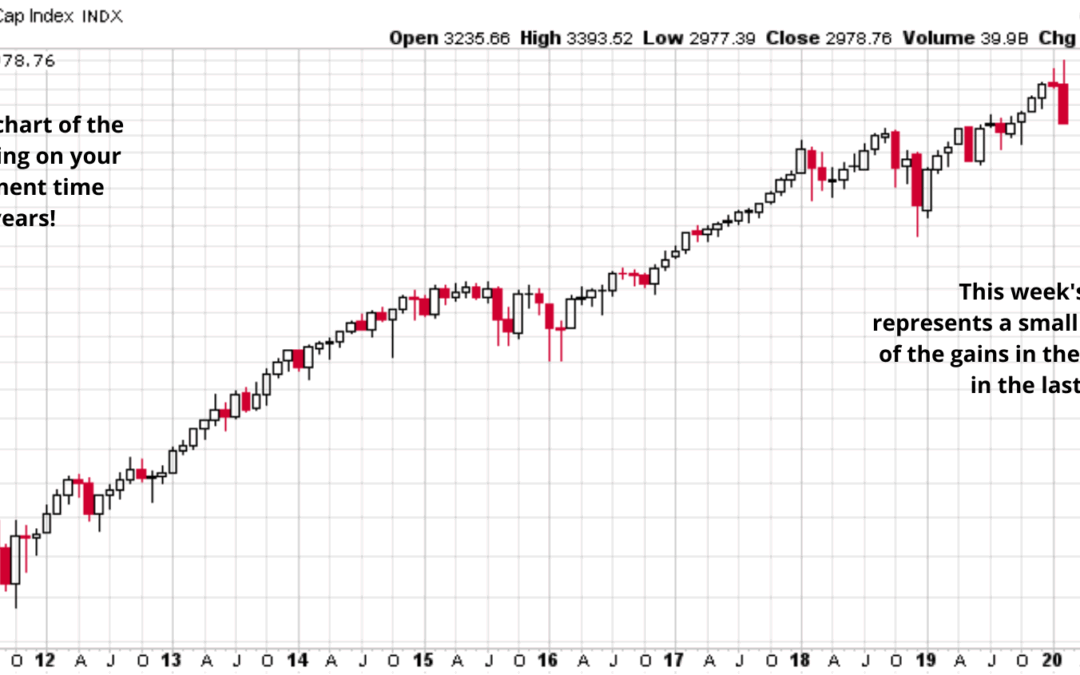

We sent the following letter out to clients and friends of Beacon Financial Advisors today… Market Update: Making Lemonade Out of Lemons A lot has changed since I emailed a couple of weeks ago. I’m sure you have been bombarded by news, articles, etc., so below...

by Kristine McKinley | Feb 29, 2020 | Uncategorized

This has been a crazy week in the stock market (and in news in general), so I wanted to check in with you and see how you are doing. The news has been dominated by the outbreak of the Coronavirus the last few weeks. At first, the stock market brushed off...

by Kristine McKinley | Oct 13, 2018 | Economy, Uncategorized

News by the Numbers Five noteworthy figures from the previous week 4.19% How much the Dow Industrials lost last week. After big plunges Wednesday and Thursday, Friday saw a rally for the index: the blue chips gained 287.16. Across the previous two days, the Dow slid...

by Kristine McKinley | Feb 6, 2018 | Uncategorized

Happy Tuesday. I just wanted to check in with you briefly and give you my thoughts on the stock market. As you are probably aware, the stock market has been very volatile in 2018 (and especially the last few days), with extreme moves to both the upside and downside....

by Kristine McKinley | Jan 13, 2018 | Uncategorized

The magic number for most people to retire is age 65. However, some people will retire before then, whether by choice or by chance. If you will be retiring before “normal retirement age”, you may face many challenges, such as how to tap into your assets, the...

by Kristine McKinley | Sep 6, 2008 | Company News, Uncategorized

Introducing a new consulting service: Jump Start Your Finances Are you: Overwhelmed by your company’s 401K choices? Confused about investment products? Living from paycheck to paycheck? Saving enough to meet your financial goals? Getting all the tax deductions you are...