by Kristine McKinley | Sep 12, 2017 | Personal Finance

By now, most of you have heard about the Equifax data breach. It is estimated that 143 million Americans were affected by this data breach so even if you weren’t affected, chances are you know someone who was. Equifax has a tool on their website that allows you...

by Kristine McKinley | Feb 11, 2016 | Investing, Personal Finance

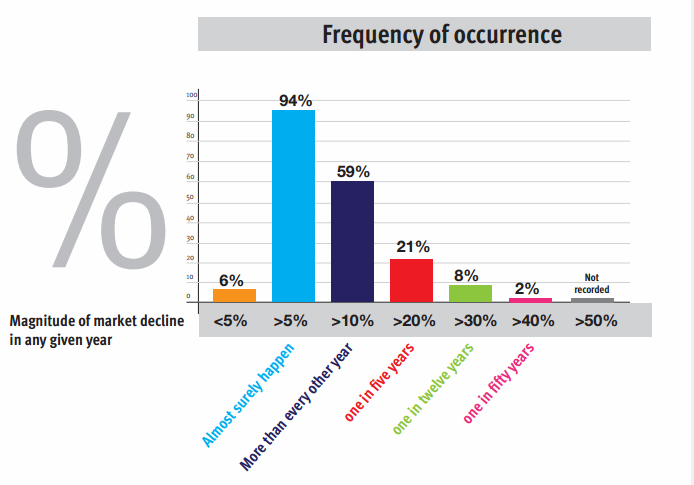

“Don’t panic.” “Don’t sell at the bottom.” “Don’t try to time the market.” You’re used to being told what you shouldn’t do when the market is falling. Today I’d like to talk about the right...

by Kristine McKinley | Jan 27, 2013 | Personal Finance, Retirement

Kiplinger magazine and the National Association of Personal Financial Advisors (NAPFA) are teaming up for the annual Jump-Start Your Retirement Plan Days to bring you free one-on-one personal finance advice. NAPFA members (including me!) from across the U.S. will be...

by Kristine McKinley | Nov 14, 2009 | Personal Finance

There’s at least a glimmer of hope for people who are currently unemployed. The Senate voted on Wednesday to extend unemployment benefits by up to 20 weeks for people currently collecting unemployment. Most states will receive a 14 week extension, but states with...

by Kristine McKinley | Jan 21, 2009 | Financial Planning, Investing, Personal Finance, Retirement

It’s hard to say what 2009 will look like. While there are still several concerns (the housing market, rising unemployment, etc.), there will also be considerable government intervention to help improve the economy this year, both in the U.S. and worldwide. So...

by Kristine McKinley | Jan 17, 2009 | Investing, Personal Finance, Retirement

After watching their 401K balances shrink up to 40% in 2008, many people are wondering if they should change their allocation to include more “safe” investments, or if they should move completely to “safe” investments then move back into the...